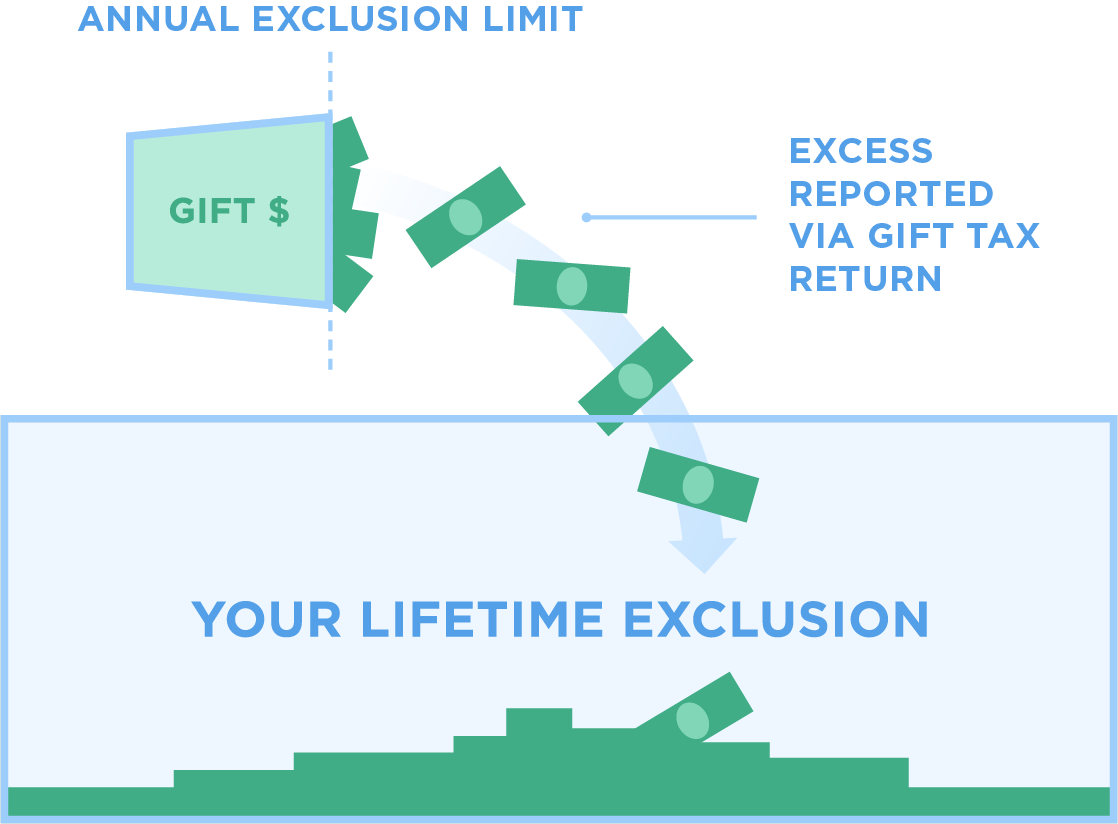

2025 Gift Tax Exemption Meaning. One is the annual gift tax exclusion, also known as the gift tax limit, a set dollar amount adjusted yearly for inflation. In the following cases, you are exempt from tax:

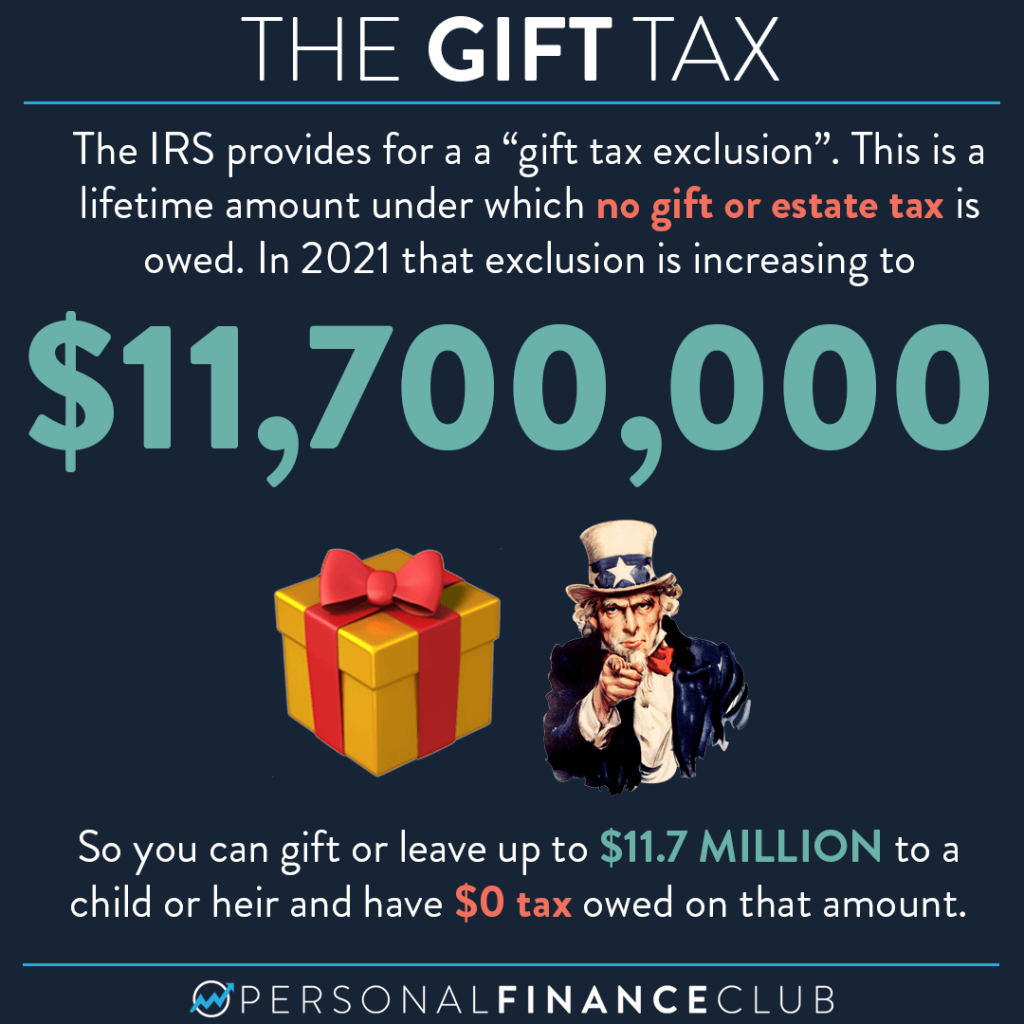

Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person. Federal gift and estate tax changes in 2025.

2025 Lifetime Gift Tax Exemption Nada Tallie, From april 1, 2025, the capital gains tax exemption for gifts under corporate restructuring will apply only to gifts by individuals or hindu undivided families.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, For 2025, you can give up to $18,000 to each recipient without triggering the gift tax, which is known as the annual gift tax exemption.

Gift Tax Lifetime Exemption 2025 Barb Marice, Gifts up to inr 50,000 in a financial year are exempt.

Lifetime Gift Tax Exemption Definition, Amounts, & Impact, For 2025, you can give up to $18,000 to each recipient without triggering the gift tax, which is known as the annual gift tax exemption.

Current Gift Tax Exemption 2025 Pauly Joelynn, There are cases or situations where gifts received are not chargeable to tax as income.

Gift Tax Exemption 2025 Alma Lyndel, Learn about the options available to taxpayers and make informed decisions to optimize tax efficiency.

2025 Gift Tax Lifetime Exemption Sybil Euphemia, It is essential to comprehend the rules of gift tax, exemption rules, and how the entire mechanism works in india because the gift tax falls under the taxation system, directly affecting recipients’ taxable income.

2025 Gift, Estate, and GST Inflation Adjusted Numbers Topel Forman L, Gifts are taxable if their aggregate value exceeds inr 50,000 in a financial year.